Crypto Custody for Business: A Quick Guide

The particular security concerns of businesses that invest in cryptocurrency and other digital assets differ from those of private users. For one, corporate cryptoasset portfolios are usually much larger and more diversified. Of more significance, though, is accountability — companies that choose to include crypto in their portfolios likely have multiple stakeholders to whom they must stay accountable.

Today, ensuring verifiably-secure custody for your company's crypto assets is easier than ever before. In this short guide, we will discuss some of the most popular technology and techniques that businesses everywhere implement as a part of their crypto-financial strategies.

Today, ensuring verifiably-secure custody for your company's crypto assets is easier than ever before. In this short guide, we will discuss some of the most popular technology and techniques that businesses everywhere implement as a part of their crypto-financial strategies.

Ultra-secure payments technology

Before getting into these tools and techniques, it's a good idea to understand crypto's ultra-secure and unhackable underlying technology — blockchain.

Blockchains themselves are made up of a collection of cryptographic security protocols. The most basic of these is the consensus algorithm, which requires all network nodes to reach agreement as to the validity of each and every transaction. Most popular blockchains today do this through the Proof of Work (PoW) consensus algorithm, where validators ('miners') are kept honest by having to use their computational resources to solve complex mathematical puzzles. In exchange for this work, miners receive coin or token rewards.

On Proof of Stake (PoS) blockchains, there exists a 'virtual computer' that delegates resources to nodes according to how many coins they hold. Here again, miners solve mathematical puzzles in order to receive rewards. However, while PoW validators are kept honest by the finances they invest into their computers, PoS protocols make sure that an attack on the network would be disadvantageous to malicious network participants. In other words, attempting to defraud the blockchain would result in staked coins being rendered less valuable. This would mean that the miner, who necessarily made a large stake of his or her own wealth, would be harming his or herself by attacking the network.

Take back control of your money

Most of today's wealth is secured by financial institutions. Your cash is largely held (and created!) by your bank. Your stocks and bonds are under the custodianship of your broker. Only crypto puts you in full control of your wealth.

After you purchase cryptocurrency on any exchange, your funds are sent to a decentralized wealth management tool called a blockchain wallet. A wallet is, in basic terms, your 'address' on the blockchain network. Any cryptocurrencies sent to that address can only be unlocked by entering a so-called 'private key,' which you can think of as your wallet password. As long as your private key is safe, your crypto is safe — there's no other way to access your money.

But how should you keep your private key safe? Well, there's a few different options, each with their advantages and disadvantages.

Before getting into these tools and techniques, it's a good idea to understand crypto's ultra-secure and unhackable underlying technology — blockchain.

Blockchains themselves are made up of a collection of cryptographic security protocols. The most basic of these is the consensus algorithm, which requires all network nodes to reach agreement as to the validity of each and every transaction. Most popular blockchains today do this through the Proof of Work (PoW) consensus algorithm, where validators ('miners') are kept honest by having to use their computational resources to solve complex mathematical puzzles. In exchange for this work, miners receive coin or token rewards.

On Proof of Stake (PoS) blockchains, there exists a 'virtual computer' that delegates resources to nodes according to how many coins they hold. Here again, miners solve mathematical puzzles in order to receive rewards. However, while PoW validators are kept honest by the finances they invest into their computers, PoS protocols make sure that an attack on the network would be disadvantageous to malicious network participants. In other words, attempting to defraud the blockchain would result in staked coins being rendered less valuable. This would mean that the miner, who necessarily made a large stake of his or her own wealth, would be harming his or herself by attacking the network.

Take back control of your money

Most of today's wealth is secured by financial institutions. Your cash is largely held (and created!) by your bank. Your stocks and bonds are under the custodianship of your broker. Only crypto puts you in full control of your wealth.

After you purchase cryptocurrency on any exchange, your funds are sent to a decentralized wealth management tool called a blockchain wallet. A wallet is, in basic terms, your 'address' on the blockchain network. Any cryptocurrencies sent to that address can only be unlocked by entering a so-called 'private key,' which you can think of as your wallet password. As long as your private key is safe, your crypto is safe — there's no other way to access your money.

But how should you keep your private key safe? Well, there's a few different options, each with their advantages and disadvantages.

Third-Party Storage or Self Custody?

Let's say you just bought your first cryptocurrency using a cryptocurrency exchange. The first thing you need to decide, now, is whether you want to be personally responsible for the security of your coins and tokens, or if you would feel better putting somebody else in charge. Both options have their benefits and drawbacks.

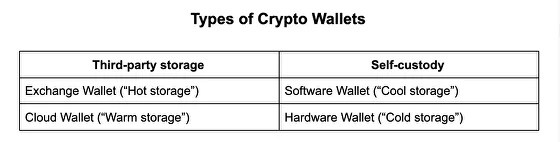

Our advice to all our clients is that they spread their crypto between a variety of custody solutions. For businesses, there is good reason to take advantage of both third-party storage — including exchange and cloud wallets — and self-custody options, like software and hardware wallets.

Hot or cold?

In the crypto space, asset custody solutions tend to be ranked by 'temperature.' The “hotter" the storage, the easier and faster it is to access funds; the “colder," the harder and slower.

Let's say you just bought your first cryptocurrency using a cryptocurrency exchange. The first thing you need to decide, now, is whether you want to be personally responsible for the security of your coins and tokens, or if you would feel better putting somebody else in charge. Both options have their benefits and drawbacks.

Our advice to all our clients is that they spread their crypto between a variety of custody solutions. For businesses, there is good reason to take advantage of both third-party storage — including exchange and cloud wallets — and self-custody options, like software and hardware wallets.

Hot or cold?

In the crypto space, asset custody solutions tend to be ranked by 'temperature.' The “hotter" the storage, the easier and faster it is to access funds; the “colder," the harder and slower.

Hot Storage - Exchange Account

The easiest place to store and manage crypto funds is probably the exchange account. Most crypto exchanges (with the exception of DEXs) maintain wallets into which your funds are sent whenever you execute a trade. From the user's perspective, this kind of custody differs little from using traditional Fintech, like PayPal, Wise, or even your online bank account. You log in using a username, password, and two-factor authentication (2FA) then are able to buy, sell, and trade assets with ease.

The main advantage of crypto exchange storage is that assets are quick to access. For businesses, exchange custody is likely the best option when planning for expenses that will need to be dealt with in the short-term. While long-term investment positions should probably be moved to a self-custody solution, corporate exchange accounts can be configured to give various employees different levels of access to funds and require transaction approval from particular stakeholders in a firm.

Hot storage may be a preferable location for some businesses to store transactional instruments, like stablecoins. Since the value of these tokens does not change, they are usually acquired for specific purposes and are generally only held for a short time. Investment assets that accrue interest in the long term are usually better sent off to other forms of custody.

Pros:

Warm Storage — Cloud Wallets

Cloud wallets are basically the crypto equivalent of your Apple or Google Pay account. A quick-to-use software-based solution, this form of third-party storage is intended for short-term crypto custody and transactional use cases.

For businesses, owing to its ease of use and quick setup, the cloud wallet can serve as a daily driver. For instance, a company can set up several cloud wallets in order to serve different roles. The wallets can be assigned to individual project teams in order to finance specific tasks. In this way, the cloud wallet serves as a kind of "business debit card," only for crypto.

Pros:

Cool Storage - Software Wallets

If you intend to hold your crypto assets long-term, we strongly encourage you to create a software wallet. A software wallet is an application that you can install on your a PC, smartphone, or any other computing device that stores your private keys. Most popular software wallets today also feature UIs that facilitate easy crypto wealth management.

The primary advantage of this kind of 'cool' storage over cloud-based wallets and exchange storage is that your funds remain under your control at all times. However, your device can be infected by malware which can give malicious actors access to your keys. Software wallet owners should be certain to store wallet backups in a secure location.

Pros:

Cons:

Cold Storage - Hardware Wallets

To investors and businesses that plan to hold larger amounts of cryptocurrency, we always recommend the purchase of a hardware wallet. These are physical devices which resemble small external hard drives or USB sticks. Hardware wallets on their own are rather inexpensive - ranging from about 75 to 150 pounds - and their purchase represents a significant amount of security for one flat fee.

We find newer generations of the wallets to be extremely beginner friendly as they feature digital touchscreen displays and streamlined user experiences. The devices are protected by advanced cryptography and are safe to use even when connected via USB with a malware-infected computer.

To larger enterprises, we usually recommend our business clients to set up multiple hardware wallets and to store backups with verified and trustworthy physical vault providers. We also encourage such clients to consider setting up multi-signature protocols that govern access to funds.

Pros:

The easiest place to store and manage crypto funds is probably the exchange account. Most crypto exchanges (with the exception of DEXs) maintain wallets into which your funds are sent whenever you execute a trade. From the user's perspective, this kind of custody differs little from using traditional Fintech, like PayPal, Wise, or even your online bank account. You log in using a username, password, and two-factor authentication (2FA) then are able to buy, sell, and trade assets with ease.

The main advantage of crypto exchange storage is that assets are quick to access. For businesses, exchange custody is likely the best option when planning for expenses that will need to be dealt with in the short-term. While long-term investment positions should probably be moved to a self-custody solution, corporate exchange accounts can be configured to give various employees different levels of access to funds and require transaction approval from particular stakeholders in a firm.

Hot storage may be a preferable location for some businesses to store transactional instruments, like stablecoins. Since the value of these tokens does not change, they are usually acquired for specific purposes and are generally only held for a short time. Investment assets that accrue interest in the long term are usually better sent off to other forms of custody.

Pros:

- Rapid access to funds

- Multi-platform (web browsers, mobile, PC)

- Exchange can get hacked or shut down

- Chance of user error (forgotten passwords, etc)

- Threat of malware

Warm Storage — Cloud Wallets

Cloud wallets are basically the crypto equivalent of your Apple or Google Pay account. A quick-to-use software-based solution, this form of third-party storage is intended for short-term crypto custody and transactional use cases.

For businesses, owing to its ease of use and quick setup, the cloud wallet can serve as a daily driver. For instance, a company can set up several cloud wallets in order to serve different roles. The wallets can be assigned to individual project teams in order to finance specific tasks. In this way, the cloud wallet serves as a kind of "business debit card," only for crypto.

Pros:

- Rapid, multi-platform, access to funds

- Quick setup

- Risk of server failure

- Malware threats

Cool Storage - Software Wallets

If you intend to hold your crypto assets long-term, we strongly encourage you to create a software wallet. A software wallet is an application that you can install on your a PC, smartphone, or any other computing device that stores your private keys. Most popular software wallets today also feature UIs that facilitate easy crypto wealth management.

The primary advantage of this kind of 'cool' storage over cloud-based wallets and exchange storage is that your funds remain under your control at all times. However, your device can be infected by malware which can give malicious actors access to your keys. Software wallet owners should be certain to store wallet backups in a secure location.

Pros:

- Free, quick, setup

- User is always in control.

Cons:

- Malware risk

- User must be sure to make and maintain backups.

Cold Storage - Hardware Wallets

To investors and businesses that plan to hold larger amounts of cryptocurrency, we always recommend the purchase of a hardware wallet. These are physical devices which resemble small external hard drives or USB sticks. Hardware wallets on their own are rather inexpensive - ranging from about 75 to 150 pounds - and their purchase represents a significant amount of security for one flat fee.

We find newer generations of the wallets to be extremely beginner friendly as they feature digital touchscreen displays and streamlined user experiences. The devices are protected by advanced cryptography and are safe to use even when connected via USB with a malware-infected computer.

To larger enterprises, we usually recommend our business clients to set up multiple hardware wallets and to store backups with verified and trustworthy physical vault providers. We also encourage such clients to consider setting up multi-signature protocols that govern access to funds.

Pros:

- Industry-grade cryptography

- Fully offline storage (eliminates malware risk)

- Easy to store and back up

- Excellent user experience (digital displays)

- Requires some initial investment

- Cannot be used on-the-go (USB input required)

- Must wait for the arrival of the device to set up wallet

Crypto Custody Strategy and Insurance

The way your company stores its digital assets depends heavily on a number of factors, including internal decision-making structures and regulations in your jurisdiction. We would be happy to assist your company in determining what kind of storage fits its needs: we specialize in developing internal policies that govern how company funds are accessed by team members and other stakeholders, including through the setup of multi-signature protocols.

Our storage solutions are fully insured by Coincover, an insurance policy that protects cryptocurrency held in online wallets against theft and malware. This policy is underwritten by Lloyds, in the UK. Feel free to get in touch to learn more.

The way your company stores its digital assets depends heavily on a number of factors, including internal decision-making structures and regulations in your jurisdiction. We would be happy to assist your company in determining what kind of storage fits its needs: we specialize in developing internal policies that govern how company funds are accessed by team members and other stakeholders, including through the setup of multi-signature protocols.

Our storage solutions are fully insured by Coincover, an insurance policy that protects cryptocurrency held in online wallets against theft and malware. This policy is underwritten by Lloyds, in the UK. Feel free to get in touch to learn more.